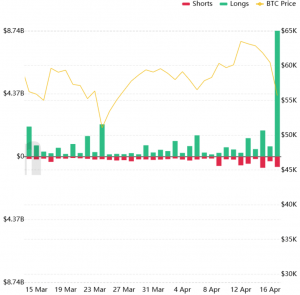

USD 9.9bn worth of trading positions in the crypto derivatives market were liquidated in the past 24 hours as the crypto market experienced a sharp selloff on Sunday.

More than USD 5bn of them are positions in bitcoin (BTC).

Total liquidations:

At around 03:00 UTC, BTC dropped from USD 59,000 to below USD 53,000, or the most in almost two months, before rebounding. At 08:18 UTC, it trades at USD 56,205 and is down by 10% in a day, erasing all its weekly and monthly gains.

The majority of other coins from the top 10 list are down by 10%-20%, while the hottest token of this week, dogecoin (DOGE) is down by 8%, trimming its weekly gains to 354%, and trading at USD 0.29.

The selloff coincided with rumored and unconfirmed claims by a popular Twitter account, FXHedge, that tweeted that the US Treasury may crack down on money laundering that’s carried out using cryptocurrencies.

Long liquidations have become more numerous this year. With bitcoin (and other coins) breaking all-time highs nearly every passing week, some traders may feel unable to gain significant exposure without margin trading. However, a growing number of traders can’t afford to maintain their leveraged positions in the event of dips. Hence, the growing frequency of big liquidations.

Leveraged trading refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. However, while margin trading enables traders to amplify their returns, it can also lead to increased losses and liquidations, which is why experienced traders tend to advise newcomers to stay away from leveraged trading.

Follow our socials Whatsapp, Facebook, Instagram, Twitter, and Google News.